Join us for the tenth edition of the Asia PE-VC Summit in Singapore (Sept 10-11) to know how asset allocators are reading the Asia opportunity amid macroeconomic headwinds.

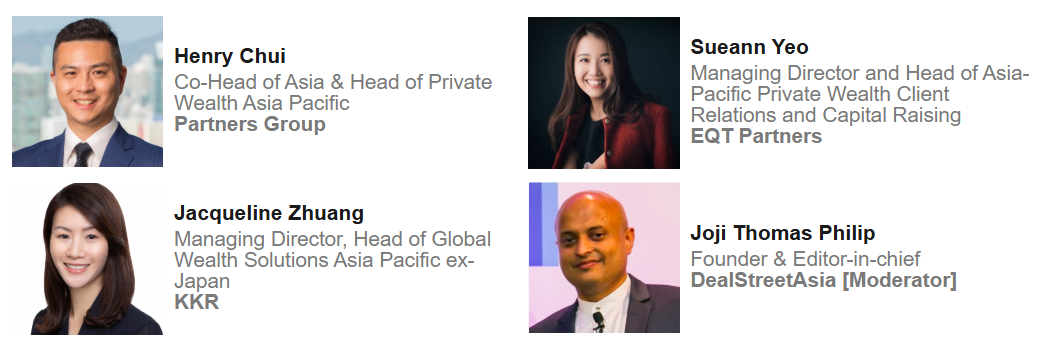

The LP-focused summit track, which will be held on day one of the summit, will focus on trends related to allocations and geographical bias, secondaries strategy, private wealth and the China opportunity.

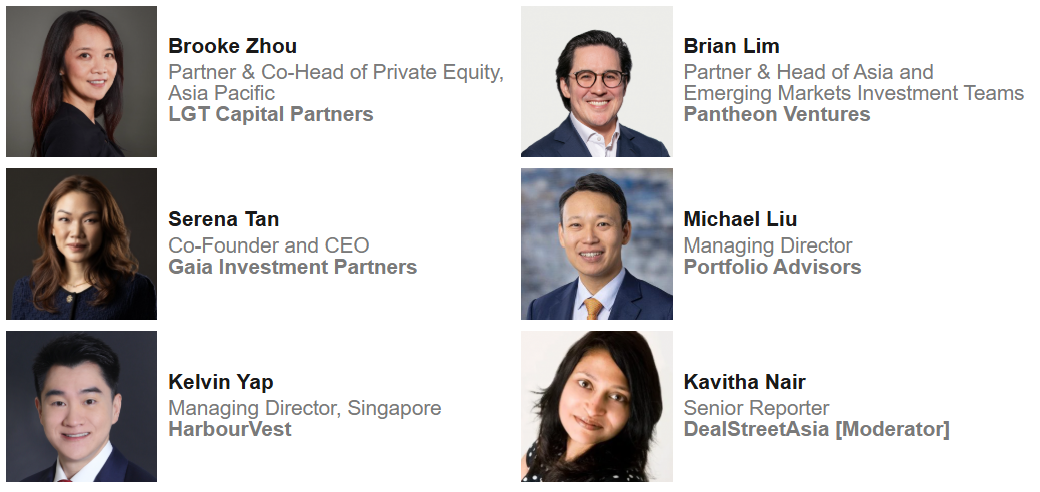

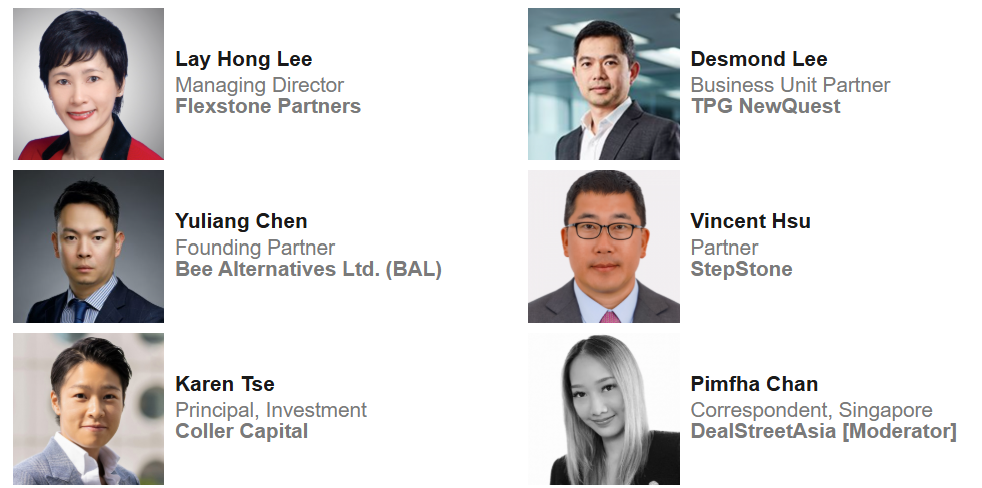

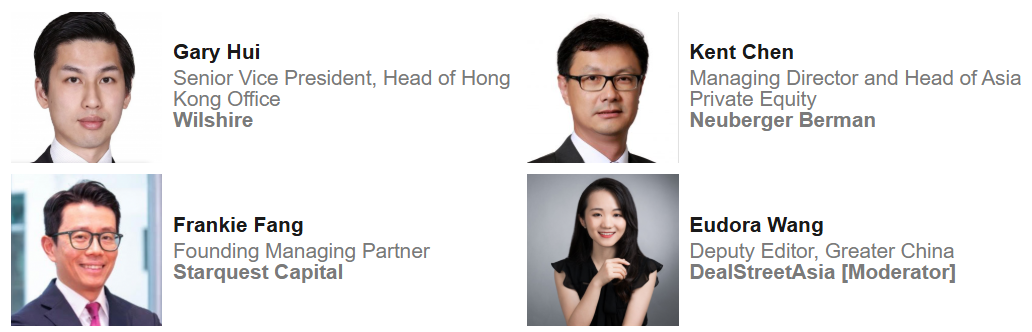

The track will bring together 15+ speakers from fund-of-funds, family offices, state-backed funds, and more. These sessions aim to provide thought leadership content and nuanced perspectives from the LP community.

Save your spot now to take away unique perspectives and a chance to make valuable connections.

ENDING TODAY!

Lock in your Asia PE-VC Summit 2025 pass today at $2,499 (save $1,000 off standard price) plus get a complimentary pass to the

Indonesia PE-VC Summit 2026 worth $999.

Get your tickets now!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|