India Deals Barometer Report: Big-ticket deals drive 40% surge in June funding

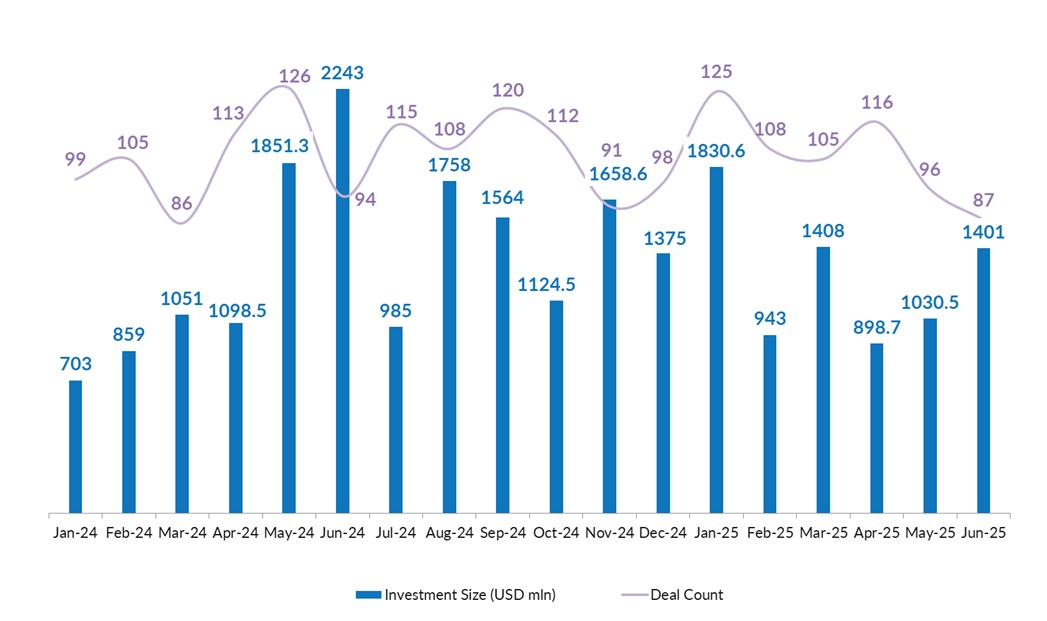

Indian startups secured $1.4 billion in funding in June, marking a significant 40% increase over the $1 billion raised in May, largely driven by a few high-value transactions that closed during the month.

Despite the increase in deal value, the volume of venture capital (VC) and private equity (PE) transactions continued to decline, with only 87 deals recorded in June compared with 96 in May, according to proprietary data compiled by DealStreetAsia.

On a year-on-year basis, deal value dropped nearly 38% from $2.24 billion in June 2024, while deal volume slipped 7% from 94 transactions during the same month last year.

The values of nine deals in June were undisclosed.

So far this year, startup fundraising from January to June has been marked by significant volatility, with an initial downward trend followed by signs of recovery. January opened strong with $1.8 billion in funding, but it dropped sharply by nearly 48% to $943 million in February. March saw a partial rebound to $1.4 billion, suggesting a brief return of investor confidence.

However, this momentum faded again in April, with funding slipping to $899 million. Encouragingly, activity picked up once more in May, signalling a potential turnaround.

Big deals make a comeback

There were at least five megadeals, or transactions worth at least $100 million, in June 2025 that accounted for nearly 49% of the month’s total deal value, the data showed. In comparison, only one megadeal was closed in May.

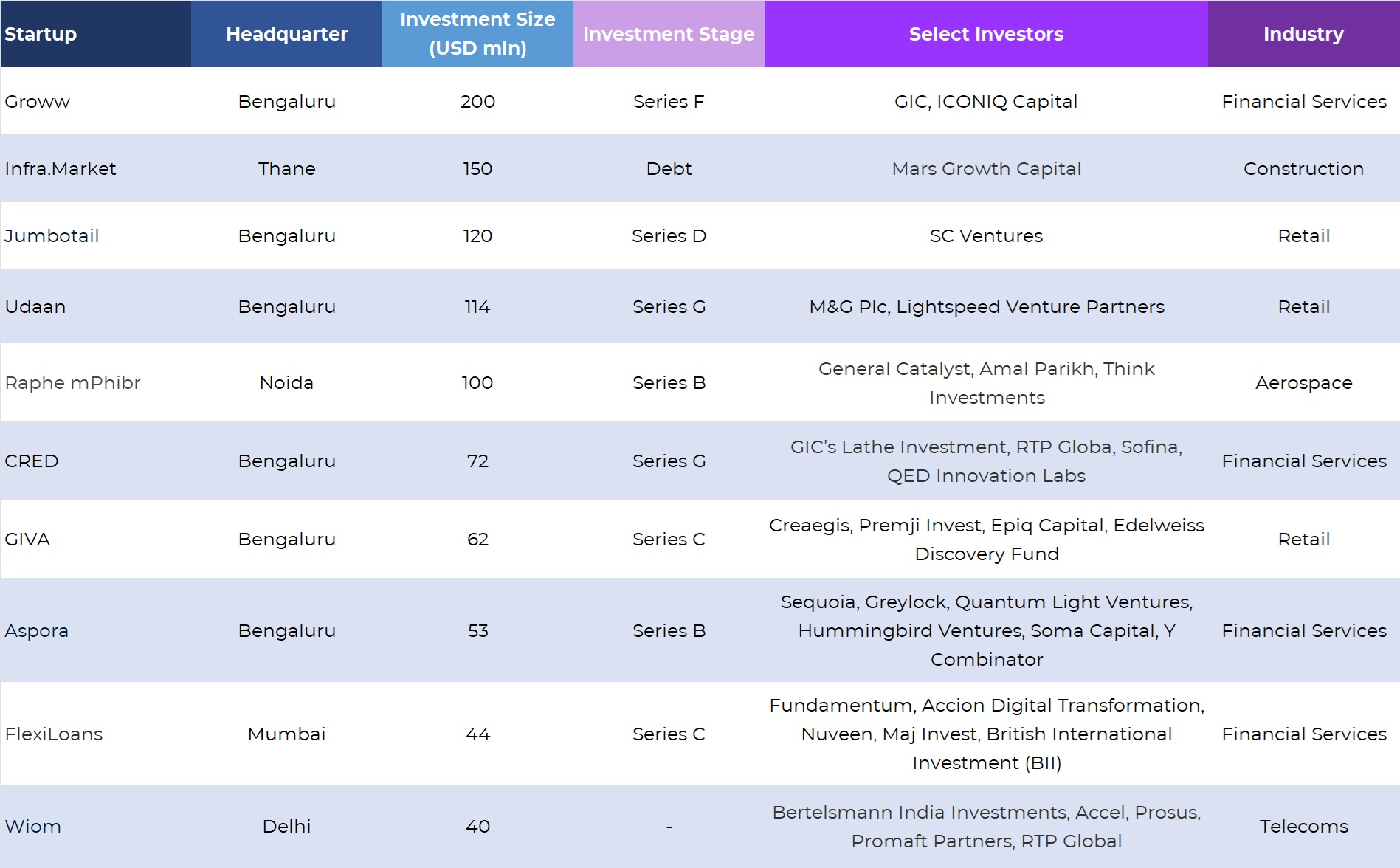

Top 10 deals in June 2025

IPO-bound fintech startup Groww led the funding charts in June, securing $200 million in its Series F round, which was spearheaded by Singapore’s sovereign wealth fund GIC along with existing backer ICONIQ Capital. The fundraising came shortly after Groww filed a confidential draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI), signalling its intent to go public. The company is reportedly aiming to raise between $700 million and $1 billion through its IPO.

Other notable deals during the month included $150 million raised by construction tech startup Infra.Market, $120 million by B2B e-commerce marketplace Jumbotail, $114 million by B2B platform Udaan, and $100 million by drone manufacturer Raphe mPhibr.

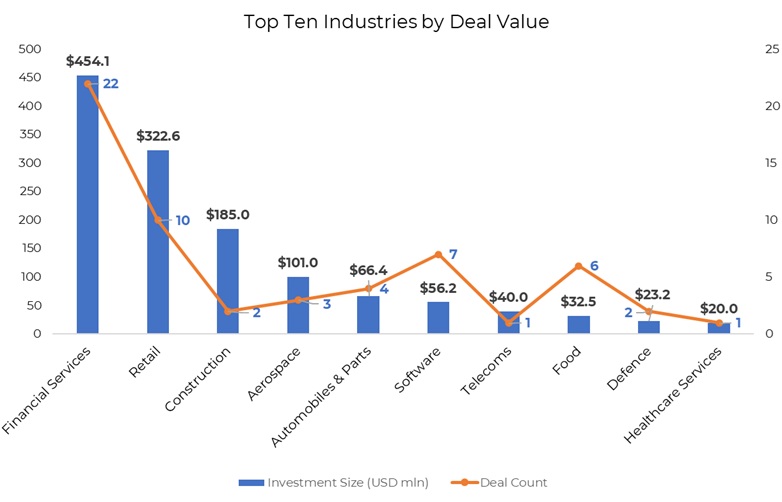

Financial services dominates the charts

Among the most funded industries in June 2025 were financial services, retail, and construction.

The financial services industry, led by the Groww deal, scooped up $454.1 million across 22 transactions. Other prominent deals within the industry included CRED ($72 million), Aspora ($53 million), FlexiLoans ($44 million), Stable Money ($20 million), and Sahi ($10.5 million).

In comparison, financial services startups secured a total of $131.6 million across 10 transactions in May.

Retail ranked as the second-most funded sector in June, attracting $322.6 million across 10 deals.

The largest transaction in the space was Jumbotail’s $120-million funding round, led by Standard Chartered’s investment arm SC Ventures. The fundraise, which also saw participation from existing investors including Artal Asia, brought Jumbotail’s total capital raised to $263 million.

Other prominent deals within retail were sealed by Udaan ($114 million), GIVA ($62 million), Aukera ($15 million) Zilo ($4.5 million), and True Diamond ($3 million).

Construction ranked third in funding, securing a total of $185 million from just two deals. Leading the industry was building materials platform Infra.Market, which secured $150 million in debt financing from Mars Growth Capital. The other deal within construction was Knest Manufacturers that raised nearly $35 million from growth-stage private equity firm Lighthouse Funds.

Together the top three industries—financial services, retail and construction—raised $962 million, or 69% of the total deal value in the month.

Investor focus shifts to growth-stage deals

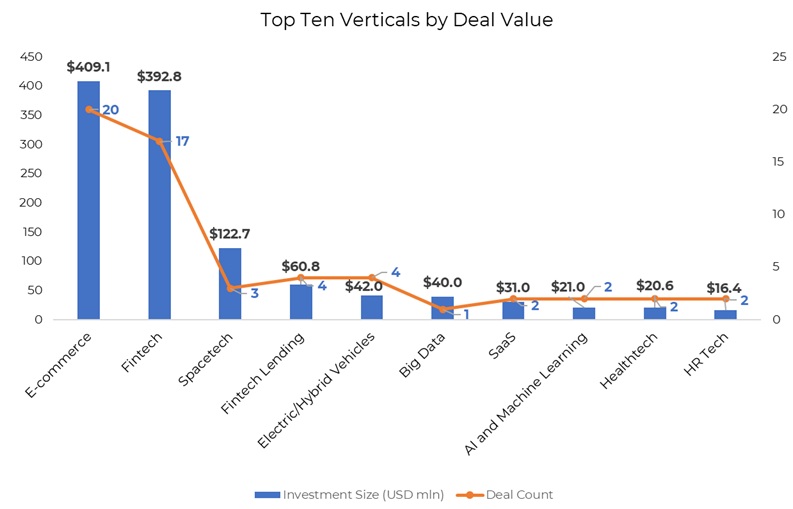

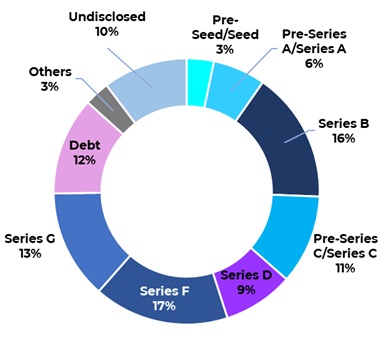

When looking at deal value, growth-stage investments—classified as Series B or later rounds (including private equity and pre-IPO rounds)—dominated funding in June, accounting for approximately 67.5% of the total deal value, up from 62% in May. These companies collectively raised $947 million through 21 deals in June, compared with $637.7 million across 20 deals in the previous month.

Prominent growth rounds in the month included Udaan ($114-million Series G), CRED ($72-million Series G), Groww ($200-million Series F), Spinny ($30.6-million Series F), GIVA ($62-million Series C), FlexiLoans ($44-million Series C), AppsForBharat ($20-million Series C), Raphe mPhibr ($100-million Series B), Aspora ($53-million Series B), and Stable Money ($20-million Series B).

Early-stage funding further dropped in the month, with startups in pre-seed and seed stages collectively raising $46.4 million from 29 deals—a drop of 45% in value from May’s $86.4 million across 32 deals. The largest seed round of $7.5 million was raised by payments platform Piston led by Spark Capital, with participation from Pear VC and BOND.

Other notable seed-stage fundraises included PowerUp Money ($7.1 million), Zilo ($4.5 million), Stride Green ($3.5 million), Illumine ($2.5 million), and Flick TV ($2.3 million).

Pre-Series A and Series A funding experienced a significant decline in June, totalling $89.6 million across 16 deals—a 51% decrease from May’s $184.3 million raised through 32 transactions.

The largest Series A round of the month came from Sanlayan Technologies, an aerospace and defence firm, that secured $21.7 million led by Ashish Kacholia, Lashit Sanghvi, and Jungle Ventures, with participation from existing investors Gemba Capital, Singularity Ventures, and new investor Shastra VC.

Other significant Series A deals included Vecmocon Technologies ($18 million), Sahi ($10.5 million), Fabheads ($10 million), GyanDhan ($5.83 million), and Oben Electric ($5.8 million).

Most active investors

Inflection Point Ventures emerged as the top investor in June with five investments, including generative artificial intelligence platform Darwix AI, HR tech platform Jobizo, healthtech startup IOM Bioworks, travel tech startup The Tarzan Way, and men’s ethnic wear brand Kisah.

Accel and British International Investment (BII) occupied the second place with four investments each. Accel’s investments in the month included telecommunications startup Wiom, stock-trading startup Sahi, composite manufacturing technology startup Fabheads, and wealthtech startup PowerUp Money. Meanwhile, BII invested in Dugar Finance, CLR Facility Services, Vecmocon Technologies, and FlexiLoans.

Other key investors included 360 ONE Asset, Avaana Capital, Blume Ventures, Fundamentum, Gemba Capital, Peak XV Partners, and RTP Global.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Bring stories like this into your inbox every day.

Sign up for our newsletter - The Daily Brief

Related Stories

Venture Capital

Greater China Deals Barometer Report: Startup fundraising hits six-month high in June

The Greater China market welcomed a dealmaking rebound as startups in the region raised over $5.6 billion in June, the highest-ever monthly deal value recorded so far this year.

Venture Capital

SE Asia Deals Barometer Report: Startup funding nearly halves in June on megadeal drought

Southeast Asia’s startup funding activity slumped in June, with both equity deal volume and investment value falling sharply from the previous month and a year earlier, dragged by the absence of big-ticket late-stage transactions.