Greater China Deals Barometer Report: Startup funding slides over 70% YoY in March

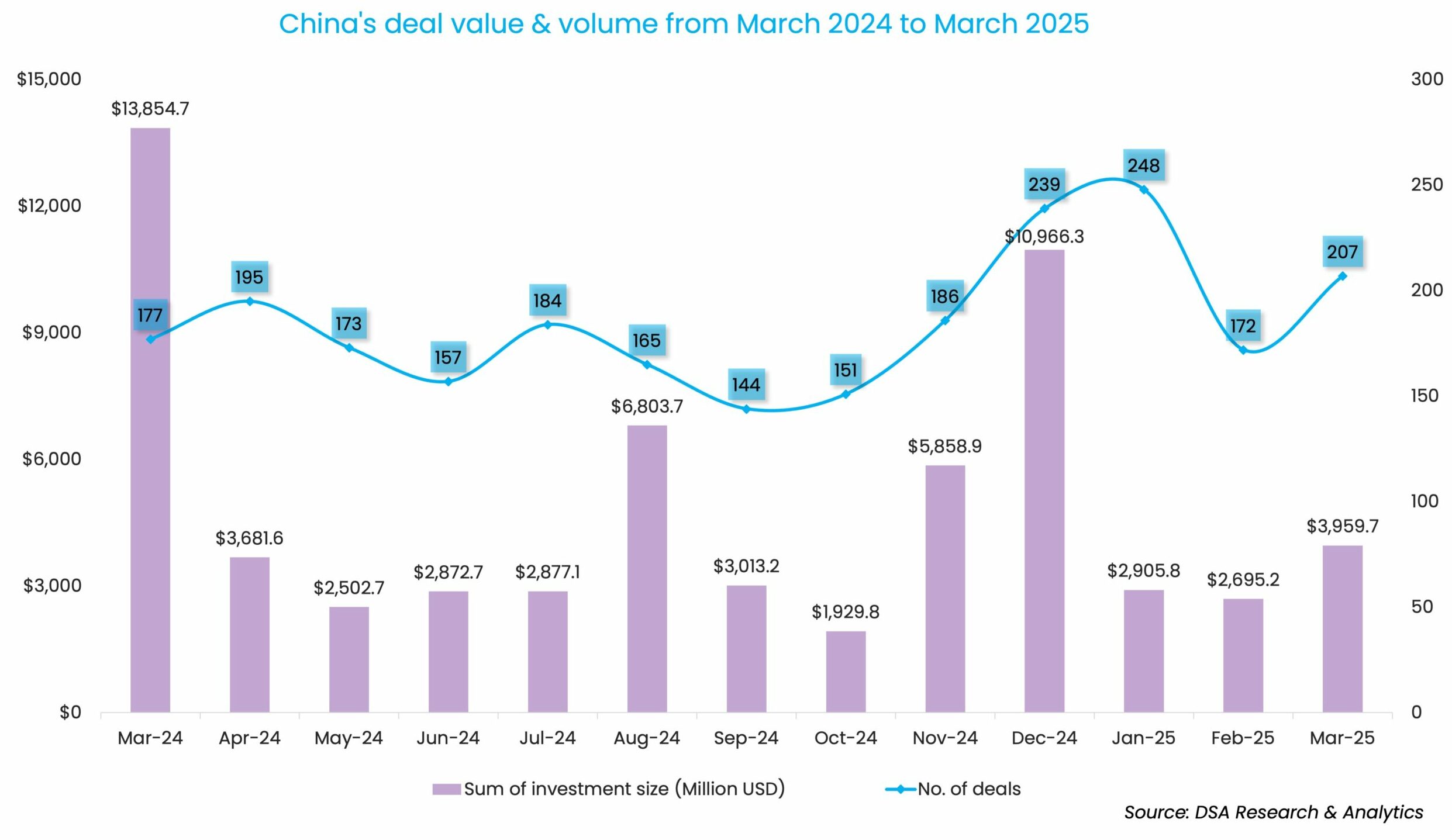

Startup funding activity in Greater China suffered a steep 71.4% year-over-year decline in transaction value in March, a month that recorded deals worth almost $4 billion.

While the plunge in deal value is typically driven by the scarcity of megadeals, or investments worth at least $100 million, what set the month apart was the unprecedented, expansive tariffs that the US rolled out recently against its major trading partners, including China.

As Beijing and Washington continue to be embroiled in the tit-for-tat tariffs, analysts from Pictet Asset Management pointed out that there’s a relative strength in the China market as the country has considerable capacity to deliver monetary and fiscal stimulus thanks to ongoing price deflation and ample fiscal space despite facing a steep import tariffs of over 50%. China’s reliance on US exports is often overstated, as it accounts for only 3% of the country’s GDP.

Overall, privately-held firms headquartered in mainland China, Hong Kong, Macau, and Taiwan completed a total of 207 funding deals in March.

Deal value was up by 46.9% month-over-month (MoM), while deal volume was up by 20.3% MoM. Some of the growth can be attributed to the week-long Lunar New Year holidays spanning from January 28 to February 4.

The first three months of 2025 saw startups in Greater China secure around $9.6 billion, 52.4% less than Q1 2024, when $20.1 billion was raised. The deal count overall held up in Q1 when 627 deals were sealed, up 1.9% from the 615 recorded during the same period a year ago.

Top deal of the month

Chinese state-owned large-scale waste incineration and power generation company SE Environment, which is controlled by power generation firm Shenzhen Energy Group, snagged the largest deal of the month, after bagging 5 billion yuan ($689.3 million) in investments.

The strategic investment round has roped in several Chinese insurers including the likes of China Life Insurance, China Taiping Life Insurance, Lian Life Insurance, and China Insurance Investment. Other investors include CCB Financial Asset Investment Fund Management and Guoxin Zhongxin Private Equity Investment Fund.

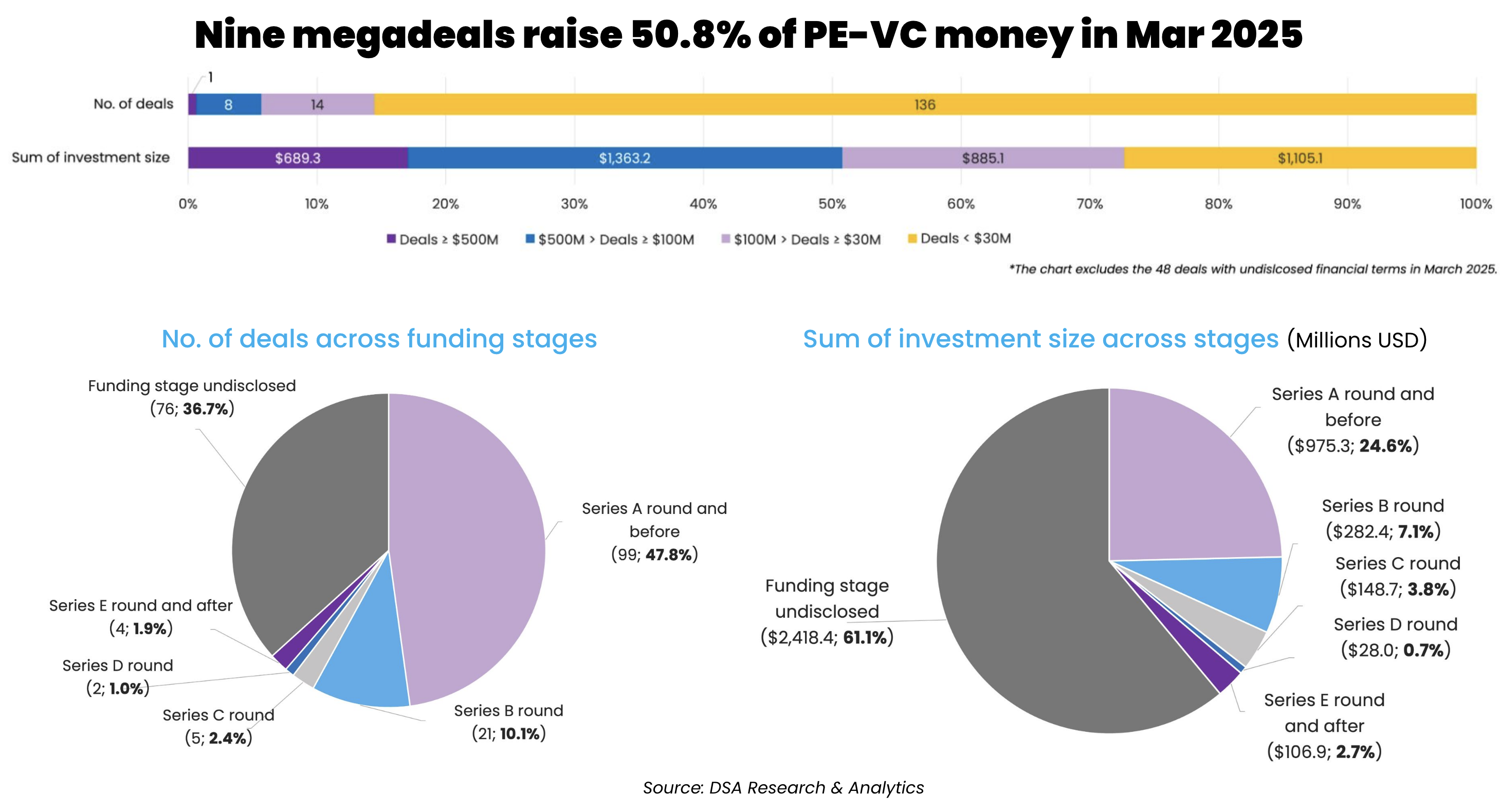

SE Environment was part of the nine megadeals in March, raising almost $2.1 billion or 50.8% of the total financing.

Chinese battery giant CATL’s proposed investment of not more than 2.5 billion yuan ($344.7 million) into local electric vehicle maker Nio as part of its battery-swapping network partnership was the second-largest deal of the month.

Two medical device firms made it to the list of megadeals in March. Pulnovo Medical, a developer of medical devices for pulmonary hypertension and heart failure, closed its oversubscribed $100 million Series C from the likes of Qiming Venture Partners and Lilly Asia Ventures (LAV).

Chinese medical device firm EverBridge Group, which produces medical devices and software related to peripheral arterial disease (PAD), neurological disorders, and tumors, secured 1 billion yuan ($137.7 million) in a Series A funding round led by healthcare-dedicated asset management firm CBC Group.

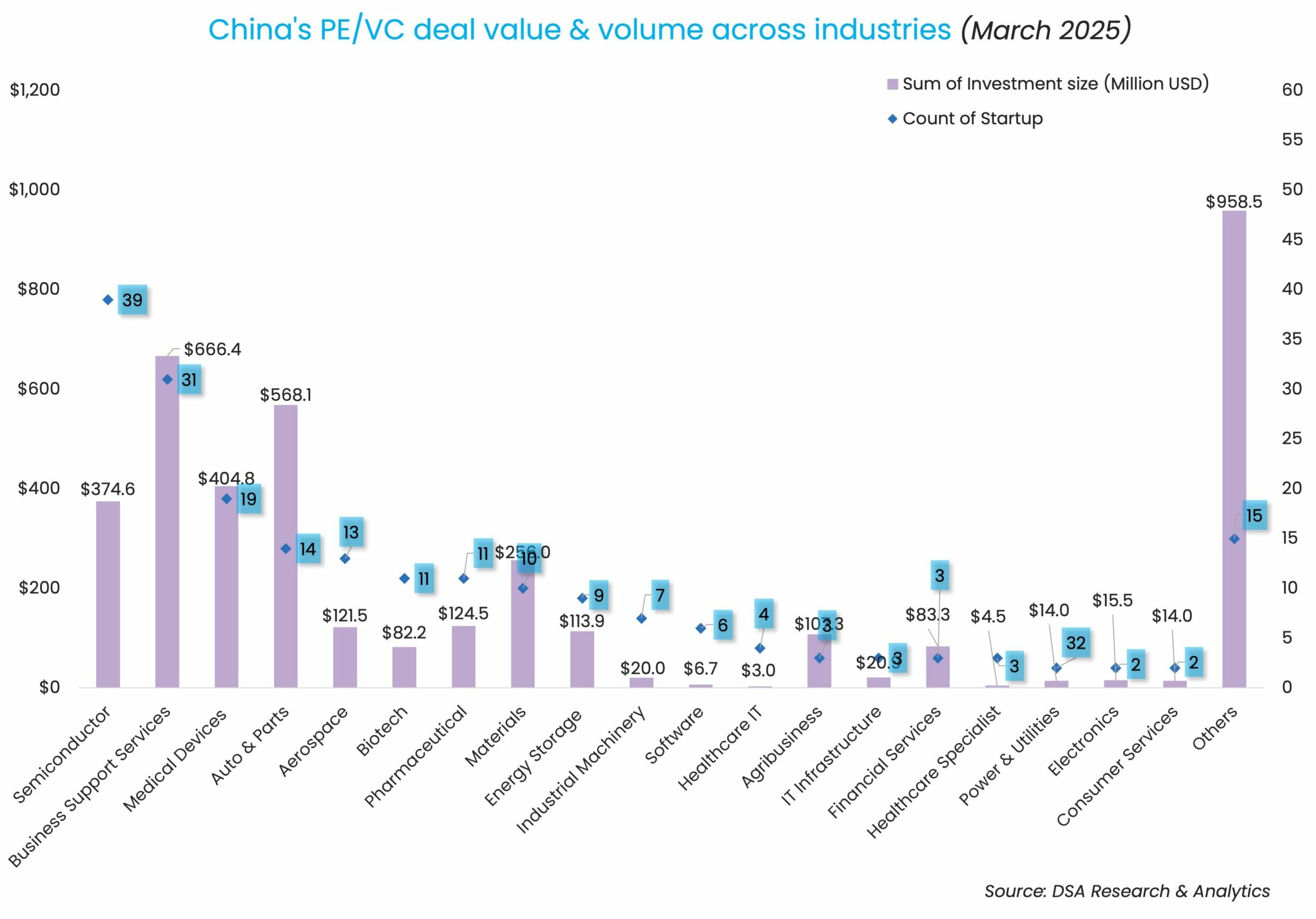

The remaining megadeals are scattered across semiconductor, materials, AI, healthcare, and business support services.

List of megadeals (March 2025)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| SE Environment | Shenzhen | 689.3 | CCB Financial Asset Investment Fund Management(Beijing), Guoxin Zhongxin Private Equity Investment Fund (国新中鑫私募股权投资基金), China Life Investment Management Company, China Insurance Investment, Taiping Life Insurance | Environmental Services | N/A | |||

| NIO | Shanghai | 344.7 | CATL | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Zhipu AI/Beijing Zhipu Huazhang Technology | Beijing | 220* | Chengdu Hi-Tech Industrial Development Zone, Huafa Group | Hangzhou Cheng Tou, Shangcheng Capital, Hangzhou Cheng Tou, Shangcheng Capital | Business Support Services | AI and Machine Learning | ||

| LY Steel Electromagnetic Material | Loudi | 206.8 | Materials | N/A | ||||

| EverBridge Group | Shanghai | 137.7 | A | CBC Group | Beijing Shunxi Venture Capital Fund Management, Beishang Capital | Medical Devices & Equipment | N/A | |

| New Frontier Health/United Family Healthcare | Beijing | 124.1 | Warburg Pincus | Healthcare Services | N/A | |||

| TARS | Shanghai | 120 | Angel | Lanchi Ventures (previously known as Bluerun Ventures), Qiming Venture Partners | Linear Capital, Hengxu Capital (affiliated with SAIC Motor Corp), Hongtai Aplus, Lenovo Capital and Incubator Group (affiliated with Legend Holdings), Xiang He Capital, GL Ventures | Business Support Services | Robotics & Drones | |

| iStar Group | Guangzhou | 109.9 | Pudong Innovation Investment, Haiwang Capital (affiliated with Spinnotec) | SDIC (Guangdong) | Semiconductor | N/A | ||

| Pulnovo Medical | Wuxi | 100 | C | Qiming Venture Partners, Lilly Asia Ventures (LAV) | OrbiMed, Gaorong Capital | Medical Devices & Equipment | N/A |

*The data combines three separate funding announcements by Zhipu AI in March.

Late-stage dealmaking revives

March saw a revival of the late-stage dealmaking scene with a total of four Series E and above rounds. The recovery in the late-stage deal activity coincided with the uptick of overseas public listings as the China Securities Regulatory Commission (CSRC) is approving more such listings than a year before.

Hong Kong is in the limelight as the relatively preferred listing destination in comparison with the bourses in the US, which is grappling with a series of policy uncertainties. Hong Kong recorded a total of 15 IPOs raising HKD 18.2 billion ($2.3 billion) in Q1 2025 compared to 12 IPOs raising HKD 4.7 billion ($604.9 million) in the same quarter last year, per Deloitte’s Q1 report.

In the US, too, a total of 21 Chinese companies launched IPOs in Q1, raising $300 million, compared to 12 new listings raising $102 million in Q1 2024, with the number of new listings and proceeds surging by 75% and 194%.

Meanwhile, early-stage investments continue to dominate the deal volume pie. Series A and pre-Series A rounds account for 47.8% of the total deal count, clocking 24.6% of the deal value.

Chinese ‘AI tigers’ strategic pivots

Zhipu AI — one of China’s “six AI tigers” — secured a total of around $220 million in three separate funding announcements in March, counting state-backed Hangzhou City Investment Group Industrial Fund, Shangcheng Capital, Chengdu Hi-Tech Industrial Development Zone, and Zhuhai Huafa Group among the investors.

The flurry of capital infusions comes at a time when the country’s AI majors are reinventing themselves in the face of DeepSeek’s rise, whose success in developing language models rivals those developed by US tech giants, has taken the world by storm.

Zhipu AI sets itself apart through a series of partnerships and investments with different local governments. Its founder said in a recent industry event that the firm will continue to focus on the different AGI as well as developing and building the best models, the firm has invested in over 30 application companies as well as forming partnerships with cities like Hong Kong, Beijing, Hangzhou, Shanghai, and Chengdu to help build LLM applications.

Besides Zhipu AI, a total of 14 firms providing AI-related services and products completed new funding rounds in March. January and February also saw fundraising by 15 and 16 firms, respectively.

Legend Holdings, Cowin Capital top investor list

Chinese conglomerate Legend Holdings was the most active investor during the month in terms of deal count. The group injected around $258.2 million across six startups through its subsidiaries.

Cowin Capital, one of China’s top venture capital firms, became the most active investor in March as it pumped $46.5 million into six startups across the verticals of materials, embodied intelligence, and e-commerce.

Qiming Venture Partners — after officially bidding farewell to managing partner Nisa Leung in February, who had been serving the firm for nearly two decades — jumped to the top of the investor list in terms of deal value in the month, investing a total of $337.1 million through five deals.

Most active investors in China (March 2025)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings & affiliates | 6 | 258.2 | 0 | 6 |

| Cowin Capital | 6 | 46.5 | 6 | 0 |

| Hefei Industry Investment Holding | 5 | 36.2 | 1 | 4 |

| Qiming Venture Partners | 5 | 337.1 | 2 | 3 |

| Wuxi Venture Capital Group | 4 | 50 | 1 | 3 |

| Addor Capital | 4 | 44.6 | 1 | 3 |

| Jiangxia Kechuang (江夏科创) | 4 | 10.2 | 0 | 4 |

| Pudong Innovation Investment | 4 | 132.3 | 2 | 2 |

| SAIC Motor Corp & affiliates | 3 | 203 | 1 | 2 |

| China Merchants Venture Capital Management | 3 | 155.8 | 1 | 2 |

| GL Ventures (affiliated with Hillhouse Capital Group) | 3 | 161.6 | 0 | 3 |

| Puhua Capital | 3 | 48.6 | 3 | 0 |

| DT Capital Partners | 3 | 9.9 | 2 | 1 |

| Kylinhall Partners | 3 | 4.5 | 3 | 0 |

Note: In our monthly analysis for March 2025, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Forget megadeals—overall startup funding fell below $100m in March

Let alone the absence of $100-million-plus deals (aka megadeals), overall startup fundraising itself failed to cross the three-digit-dollar mark in Southeast Asia in March.

Venture Capital

India Deals Barometer Report: Three megadeals drive 49% rise in March startup funding

Venture funding in India once again crossed the psychologically significant $1-billion mark in March, thanks to three major deals in the fintech and software sectors, reflecting a shift in investor focus towards high-growth-potential startups.